- Docs

TrueFi for Institutions

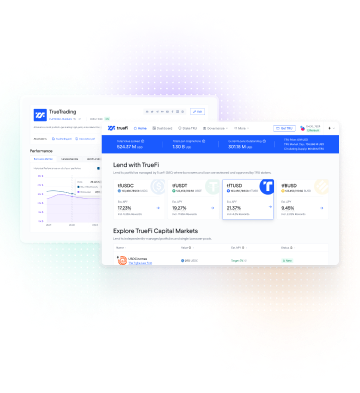

TrueFi capital markets connect lenders, borrowers, and portfolio managers with the world’s best financial opportunities.

Trusted by...

Lend, Borrow, and Manage Assets On-Chain with TrueFi

TrueFi's capital market allows portfolio managers to launch nearly any type of financial opportunity on-chain, with access to global liquidity from day one. Portfolio managers also enjoy access to TrueFi's vast pool of lenders and borrowers, as well as TrustToken's institutional-grade services designed to help bridge traditional finance to DeFi.

Explore how TrueFi can help you:

PORTFOLIO MANAGERS

Why launch your portfolio on TrueFi?

Bring your financing on-chain to lower costs and tap global liquidity, all while maintaining nuanced controls over your portfolio. For guidance and portfolio services, providers like TrustToken are ready to help your business become DeFi-native.

Become a Portfolio Manager$ 3,320,000 USD

Earned by Portfolio Managers since launch

Lender Selection

Choose your lender restrictions, from open global access, up to bank-grade KYC and geo-specific availability.

Fee Structure

Choose your management and performance fees.

Strategy

Oversee withdrawals, deposits, and allocations in your portfolio.

Duration

Decide the length of your portfolio as well as the length of individual loans.

Reduced business overhead

TrueFi opens access to lenders, borrowers, and services to let you focus on allocating capital.

Access On-Chain Liquidity

Tap DeFi's billions in liquidity looking for unique financial opportunities.

Deep control of your portfolio

Set the portfolio's strategy, fee structure, terms and more.

Best of Blockchain

Enjoy 24/7 operations, global reach, industry-leading security, and unparalleled transparency.

Our institutional users on TrueFi

Billions of dollars originated

Banking-grade security

Industry-leading underwriting record

Institutional lending & management support

Billions of dollars originated

Banking-grade security

Industry-leading underwriting record

Institutional lending & management support

Billions of dollars originated

Banking-grade security

Industry-leading underwriting record

Institutional lending & management support

Billions of dollars originated

Banking-grade security

Industry-leading underwriting record

Institutional lending & management support

Billions of dollars originated

Banking-grade security

Industry-leading underwriting record

Institutional lending & management support

Billions of dollars originated

Banking-grade security

Industry-leading underwriting record

Institutional lending & management support

Billions of dollars originated

Banking-grade security

Industry-leading underwriting record

Institutional lending & management support

Billions of dollars originated

Banking-grade security

Industry-leading underwriting record

Institutional lending & management support

Billions of dollars originated

Banking-grade security

Industry-leading underwriting record

Institutional lending & management support

Audited by...

Institutional loans in as little as 7 days

* Disclaimer: The information contained in this website, including the historical average APR, are intended for informational purposes only. Some of the information may be dated and may not reflect the most current information or lending rates. Lending rates are based on the creditworthiness of individual borrowers and are subject to change.